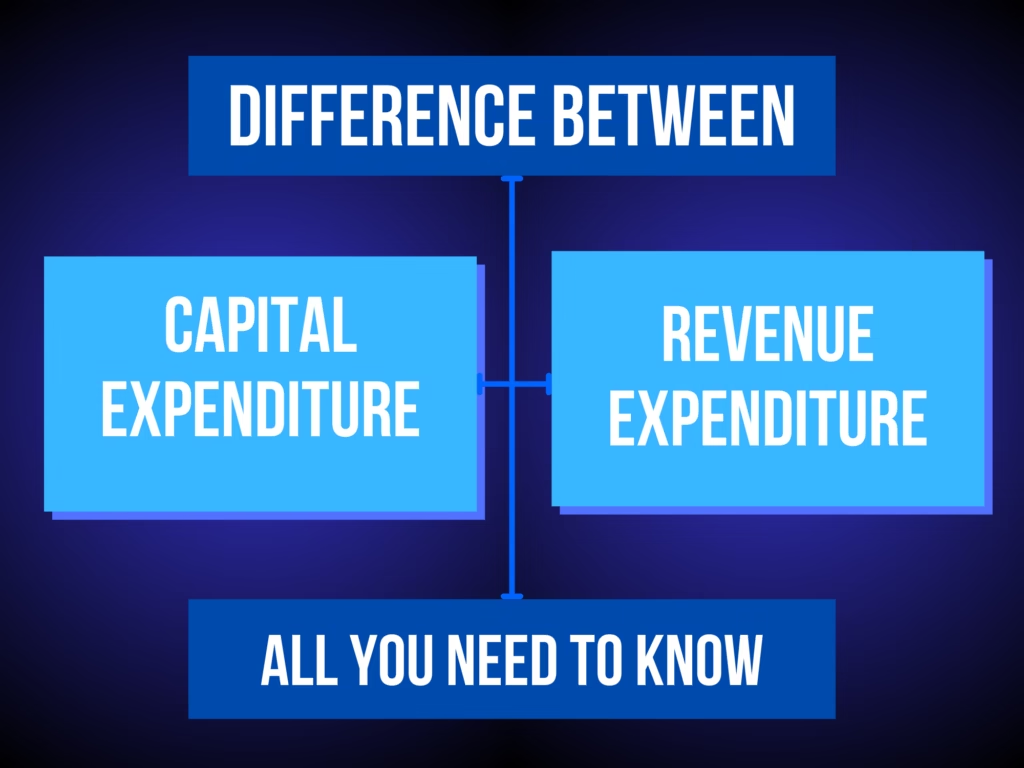

When a business pays for web design, it’s important to determine whether the expense is a capital cost or a revenue cost. This classification affects tax deductions and whether the cost is immediately deductible or needs to be spread out over time.

Capital Expenditure (Long-Term Asset)

If you’re building a new website from scratch or adding major new functionality (e.g., an e-commerce store, booking system, or custom-built features), it’s considered a capital expense. This is because the website provides lasting benefits to your business.

Example: A hotel chain invests in a brand-new online booking platform. This is a long-term investment, so it’s capital expenditure.

Revenue Expenditure (Ongoing Costs)

If your website costs are for routine updates, content changes, or general maintenance, these are treated as revenue expenses. Unlike capital expenses, revenue expenses can be fully deducted in the year they occur.

Example: A business hires a web designer to update text, images, and add new blog posts. These are day-to-day operational costs and are tax-deductible.

HMRC’s official guidance on capital vs. revenue expenses: gov.uk

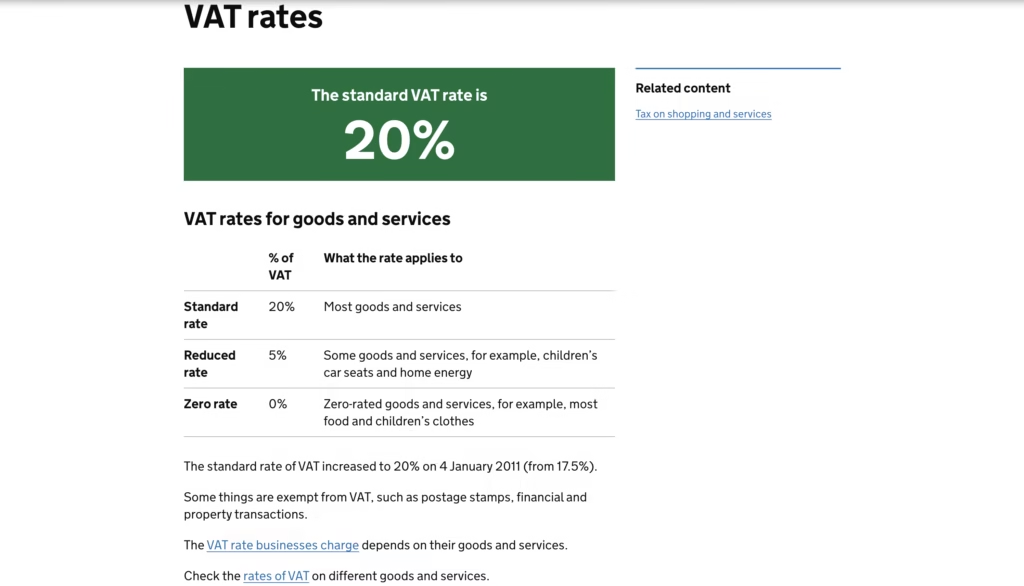

If a web design agency or freelancer is VAT-registered, they must charge VAT on their services at the standard 20% rate.

Example: A VAT-registered company pays £1,000 + VAT for a website redesign. They can reclaim the £200 VAT on their VAT return.

Check the latest UK VAT rates here: gov.uk

Yes, but only if your website costs qualify as a revenue expense. If you hire a designer for ongoing updates, SEO, or minor fixes, these costs can be fully deducted from taxable profits.

Deductible Website Costs Include:

✔️ Website hosting & domain fees

✔️ Regular updates & maintenance

✔️ SEO, blog writing & content updates

Non-Deductible (Capital) Website Costs Include:

❌ A brand-new website build

❌ A custom e-commerce platform

❌ A complete website overhaul with new features

Association of Taxation Technicians’ (ATT) guide on software & website costs: att.org.uk

If your website is classified as a capital expense, you can’t claim an immediate deduction, but you may qualify for Capital Allowances.

Capital Allowances let you claim tax relief on business assets over time. In some cases, web development costs can qualify under the Annual Investment Allowance (AIA), meaning you could claim up to 100% tax relief in the first year.

Who Can Claim?

Who Cannot Claim?

HMRC’s official Capital Allowances guidance: gov.uk

To get the most tax benefits from your web design costs, classify them correctly and keep good records. Here’s what you need to remember:

✔️ If it’s a new website build → Capital expenditure (may qualify for Capital Allowances).

✔️ If it’s website maintenance or updates → Revenue expenditure (fully tax-deductible).

✔️ VAT applies if your provider is VAT-registered (20%), but VAT-registered businesses can reclaim it.

Since tax laws change regularly, it’s always best to consult an accountant to ensure you’re maximising your deductions while staying compliant with HMRC rules.

Need a website that works for your business? Contact Uniswell today!

Yes, but it depends on the type of expense. Routine website updates and maintenance are considered revenue expenses and can be deducted in full in the year they occur. However, a new website build or major upgrades are usually treated as capital expenditure, which means they cannot be deducted immediately but may qualify for Capital Allowances.

If your web designer or agency is VAT-registered, they must charge 20% VAT on their services. If your business is also VAT-registered, you can reclaim the VAT on your tax return. However, non-VAT registered businesses and individuals cannot reclaim VAT, making the service more expensive.

Yes, if the website is considered a long-term business asset (e.g., an e-commerce site with custom features). Businesses may be able to claim tax relief over time under Capital Allowances or even 100% tax relief upfront under the Annual Investment Allowance (AIA), depending on eligibility.

To ensure compliance, businesses should keep:

We believe that a great website is more than just pixels and code—it’s a powerful business tool. Based in Dorset, we specialise in web design, development and digital marketing to help businesses stand out and grow online.

We’re here to make growing your online presence as smooth and stress free as possible. Whether you’re looking for a standout website, reliable hosting, or a full digital strategy, we’d love to hear from you.

Empowering businesses with innovative digital solutions to inspire, connect, and grow.